生意编号40361

最近更新2026年03月01日

3229人已浏览

🚀 Sg-Based Quant Prop Firm & Fintech Startup Raising Partners & Investors

红山投资理财

转让费价格面议

生意转让

寻求投资

合作伙伴

Louis

我要咨询

生意概述

- 物业类型 办公楼

- 物业面积 12917尺² / 1200米²

- 每月租金 一

- 房租押金 一

- 月营业额 一

- 欠款负债 一

- 月毛利润 一

- 月净利润 一

- 库 存 一

- 设施设备 一

- 应付帐款 一

- 应收账款 一

- 卖家职责 全职

- 员工人数 10

- 成立时间 2024

- 发布来源 个人

转让原因

looking for partners

生意详情

🚀 SG prop firm - A Dual-Engine Business: Quant Prop Trading + AI Fintech Startup

We operates two engines in parallel:

(1) a high-performing quantitative proprietary trading firm running fully automated intraday strategies in U.S. markets, and

(2) a fast-scaling AI-native fintech startup building Asia’s first “vibe-trading” app that lets everyday users create trading algorithms through natural language.

🏢 Who We Are

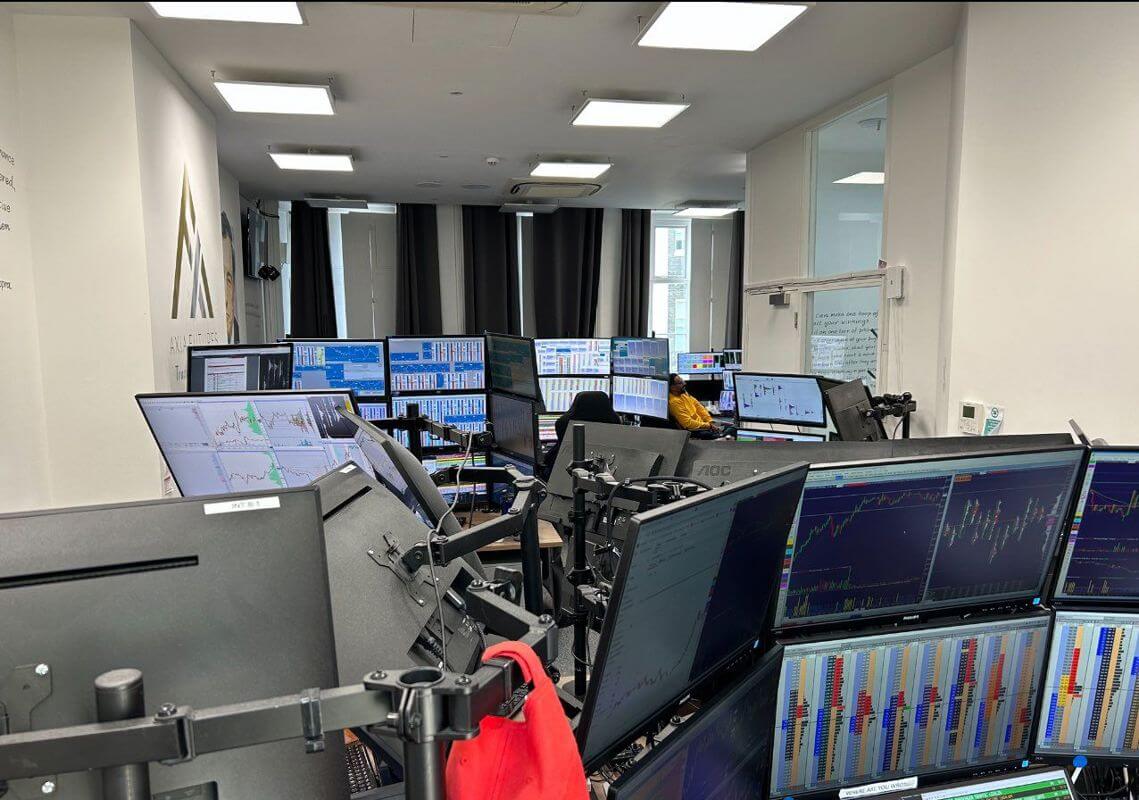

We are a fully automated quant trading firm specializing in U.S. equities, with expanding operations in crypto arbitrage, futures, and multi-asset systematic strategies.

Key stats:

AUM: USD $3M+

Daily Turnover: ~20%

Team: 7 full-time (C++ engineers, AI researchers, quant traders)

30+ proprietary trading algorithms

Full in-house AI research & C++ trading engine

Exchange connectivity: NYSE / Nasdaq / Cboe / crypto venues

Our burn rate is extremely lean — 47k–52k SGD/month covering full team, infra & office.

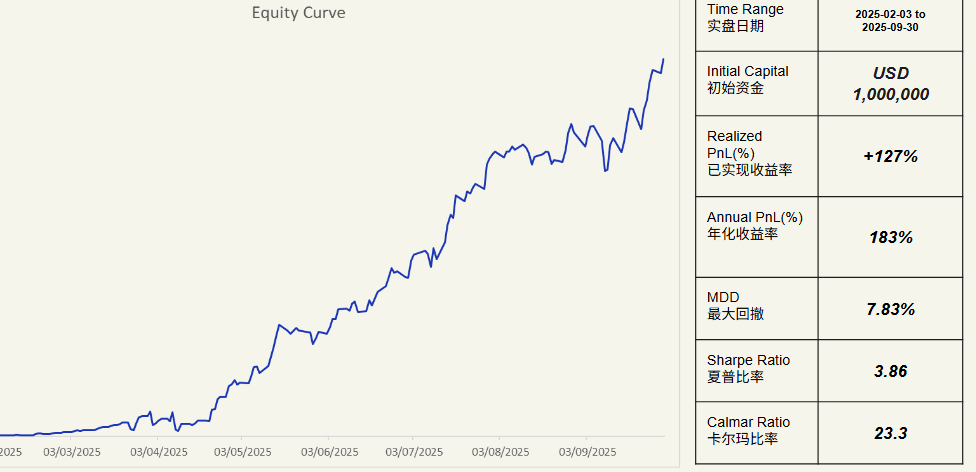

📈 Live Trading Performance

US Equities Portfolio (Feb–Sep 2025):

+127% realized return

Annualized: 183%

Sharpe: 3.86

Max Drawdown: 7.83%

Calmar: 23.3

Benchmarks (same period):

QQQ: +18.7%

S&P500: +12.3%

🧠 What Makes Us Different

1️⃣ AI-Native Strategy Engine

Our system automatically creates, validates, and improves trading strategies using multi-agent AI.

Already 30+ validated strategies across different market regimes.

2️⃣ Full Automated Trading Stack

Built fully in-house:

Low-latency C++ engine

High-throughput data pipelines

Real-time execution engine

Ultra-fast backtesting

Multi-asset support (US equities, crypto, futures, stablecoins)

3️⃣ Lean, Scalable Operations

Automation allows us to scale AUM and products without ballooning headcount.

Low error rates, high reliability, and extremely efficient burn.

📱 Fintech Product — Asia’s First AI “Vibe-Trading” App

We’re building Asia’s first AI-native platform where anyone can create trading algorithms using simple natural language.

No coding.

No complex charts.

Just describe the idea—and the AI builds the algo end-to-end (backtest → optimize → deploy).

Think of it as “ChatGPT for trading algos.”

We are preparing to raise ~SGD 1M angel round for product expansion.

💰 What We’re Raising

1) Angel & Strategic Equity Investors (Company Level)

Minimum ticket: SGD 300k

Investment type:

Equity investment at Varsity Technology (Holding Company)

Use of funds:

• Strengthen AI research & trading infrastructure

• Build and scale the fintech product & engineering team

• Support core technology development and commercialization

2) Strategic Partners

We welcome partners in:

Technology (AI, infra, C++ trading systems)

Finance (fundraising, compliance, structuring)

HR & Operations (hiring, scaling, organization building)

If you want to help build the next major quant fund + AI trading platform in Asia, we want to talk.

We operates two engines in parallel:

(1) a high-performing quantitative proprietary trading firm running fully automated intraday strategies in U.S. markets, and

(2) a fast-scaling AI-native fintech startup building Asia’s first “vibe-trading” app that lets everyday users create trading algorithms through natural language.

🏢 Who We Are

We are a fully automated quant trading firm specializing in U.S. equities, with expanding operations in crypto arbitrage, futures, and multi-asset systematic strategies.

Key stats:

AUM: USD $3M+

Daily Turnover: ~20%

Team: 7 full-time (C++ engineers, AI researchers, quant traders)

30+ proprietary trading algorithms

Full in-house AI research & C++ trading engine

Exchange connectivity: NYSE / Nasdaq / Cboe / crypto venues

Our burn rate is extremely lean — 47k–52k SGD/month covering full team, infra & office.

📈 Live Trading Performance

US Equities Portfolio (Feb–Sep 2025):

+127% realized return

Annualized: 183%

Sharpe: 3.86

Max Drawdown: 7.83%

Calmar: 23.3

Benchmarks (same period):

QQQ: +18.7%

S&P500: +12.3%

🧠 What Makes Us Different

1️⃣ AI-Native Strategy Engine

Our system automatically creates, validates, and improves trading strategies using multi-agent AI.

Already 30+ validated strategies across different market regimes.

2️⃣ Full Automated Trading Stack

Built fully in-house:

Low-latency C++ engine

High-throughput data pipelines

Real-time execution engine

Ultra-fast backtesting

Multi-asset support (US equities, crypto, futures, stablecoins)

3️⃣ Lean, Scalable Operations

Automation allows us to scale AUM and products without ballooning headcount.

Low error rates, high reliability, and extremely efficient burn.

📱 Fintech Product — Asia’s First AI “Vibe-Trading” App

We’re building Asia’s first AI-native platform where anyone can create trading algorithms using simple natural language.

No coding.

No complex charts.

Just describe the idea—and the AI builds the algo end-to-end (backtest → optimize → deploy).

Think of it as “ChatGPT for trading algos.”

We are preparing to raise ~SGD 1M angel round for product expansion.

💰 What We’re Raising

1) Angel & Strategic Equity Investors (Company Level)

Minimum ticket: SGD 300k

Investment type:

Equity investment at Varsity Technology (Holding Company)

Use of funds:

• Strengthen AI research & trading infrastructure

• Build and scale the fintech product & engineering team

• Support core technology development and commercialization

2) Strategic Partners

We welcome partners in:

Technology (AI, infra, C++ trading systems)

Finance (fundraising, compliance, structuring)

HR & Operations (hiring, scaling, organization building)

If you want to help build the next major quant fund + AI trading platform in Asia, we want to talk.

物业信息

租赁

物业类型

会员专区

我要咨询

请使用英文发送留言

* 您的姓名

▼

* 手机号码

* 电子邮箱

留言详情

所有广告信息均由卖家或其代表提供。我们不对信息的准确性、完整性或真实性进行核实,也不提供任何保证或担保。任何因此而产生的纠纷、索赔或决定,均应由买卖双方自行承担和解决。了解更多 如何避免诈骗。