生意编号40821

最近更新2026年02月18日

11人已浏览

Buy This Store Ready For Systematic Improvement + 30-Day Support

牛车水网店

转让费$9万(可商)

生意转让

寻求投资

合作伙伴

Trendhijacking

我要咨询

生意概述

- 物业类型 在家经营

- 物业面积 一

- 每月租金 一

- 房租押金 一

- 月营业额 一

- 欠款负债 一

- 月毛利润 一

- 月净利润 一

- 库 存 一

- 设施设备 一

- 应付帐款 一

- 应收账款 一

- 卖家职责 全职

- 员工人数 10

- 成立时间 2021

- 发布来源 个人

转让原因

business

生意详情

What if you could compress a decade of returns into 24 months with a clear acquisition-exit strategy you control?

That's exactly what our Acquisition Program delivers.

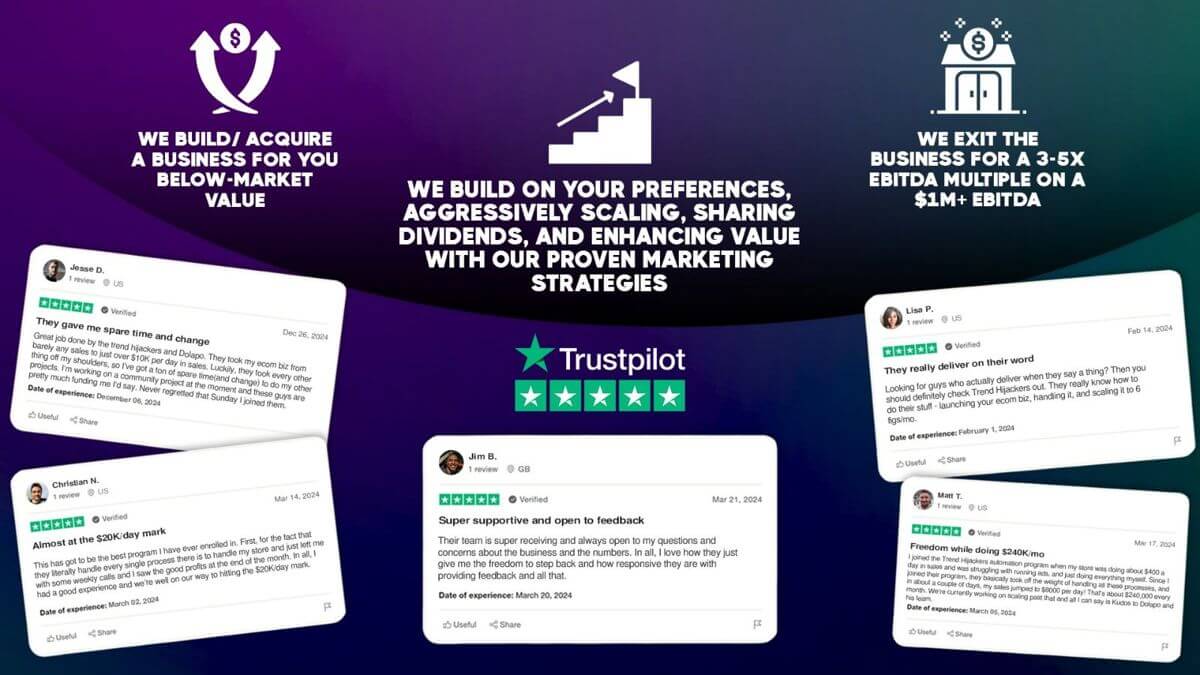

We, at Trend Hijacking, help you acquire operating e-commerce businesses below market value, systematically multiply their profit through proven improvements, and engineer exits at premium multiples within a defined holding period (~1-3 years).

Working with us means executing a proprietary value-creation strategy with a specific timeline and exit target that has consistently performed across over 491 partners.

Here’s how our playbook works:

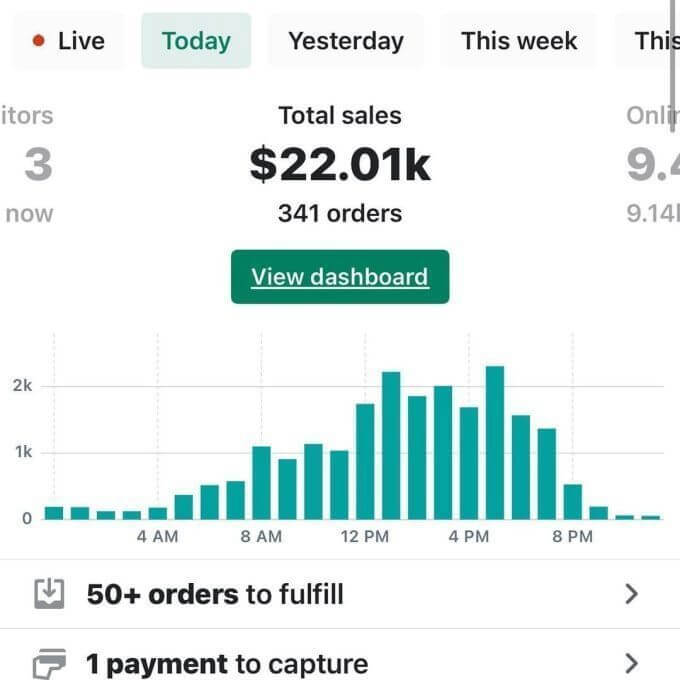

We acquire at 20-40% below market value (instant equity), improve operations to drive 5-10× profit growth (value creation), exit at 3-5× EBITDA (premium capture),

And achieve total returns of 100-150%+ over 24 months (compressed timeline).

This is how private equity firms operate, except instead of being a passive LP in someone else's fund, you own the asset outright and control the timeline.

Our team executes the entire strategy. So you're not operating the business.

You're not managing marketing campaigns. You're not handling fulfillment logistics.

We source opportunities, conduct forensic due diligence, manage operations, implement growth strategies, and position for exit. You deploy capital and receive regular progress updates.

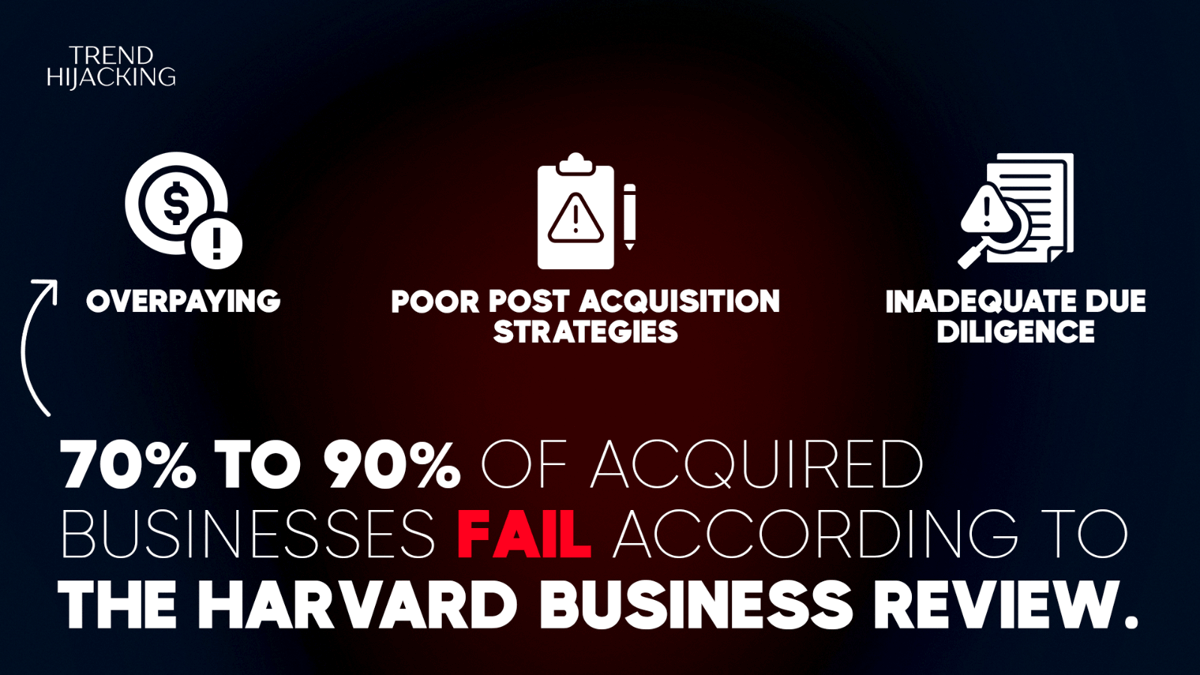

We've managed over $41.5 million in revenue.

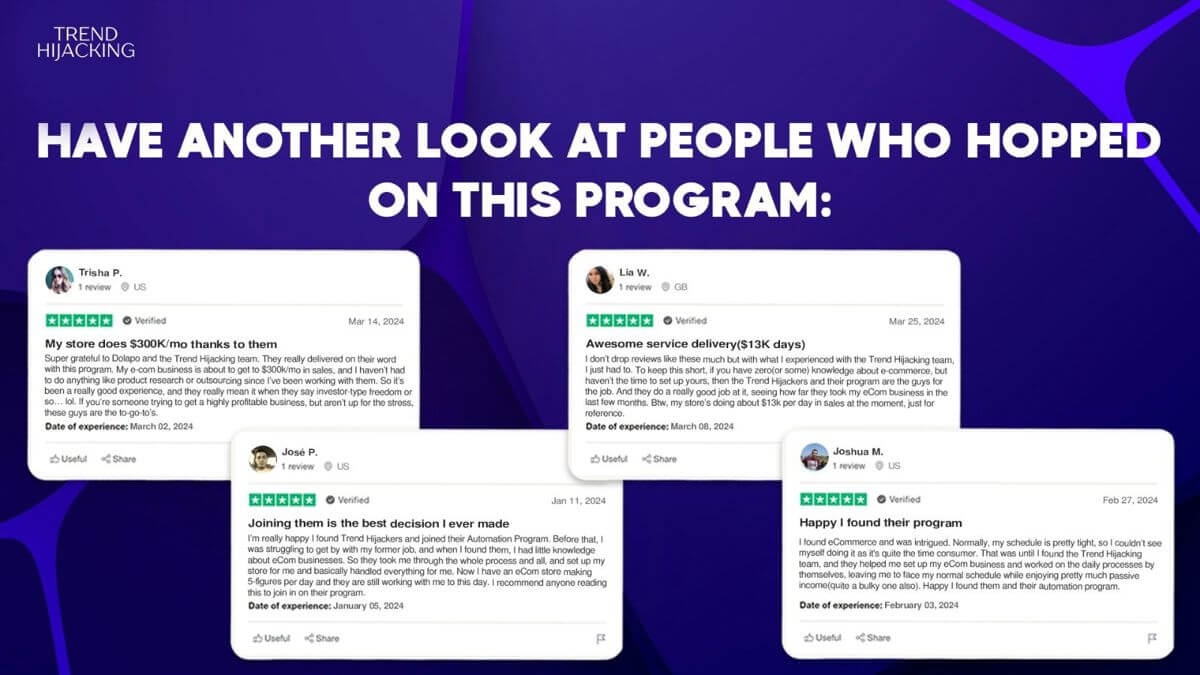

And we have a number of documented case studies all showing the same thing: we consistently generate multiple returns for our partners…

With a good number recouping their initial investment with us months into working with us…

Now we understand that you may be skeptical of our process and claims… That is why we offer a 14-day ‘buy & launch’ evaluation period with zero obligations…

So you can assess this opportunity without having to commit with a heavy retainer like with some broker or agency.

Many investors accept whatever timeline the market gives them. You don't have to.

With operating businesses, you control when to enter, how aggressively to improve, and when to exit.

The timeline is yours and is not dictated by market cycles or fund lockups.

The question is: would you rather wait a decade for uncertain returns, or execute a strategy with defined milestones?

Then schedule a 1:1 consultation w/ one of our consultants at TrendHijacking.com and we’ll show you what’s possible with you.

That's exactly what our Acquisition Program delivers.

We, at Trend Hijacking, help you acquire operating e-commerce businesses below market value, systematically multiply their profit through proven improvements, and engineer exits at premium multiples within a defined holding period (~1-3 years).

Working with us means executing a proprietary value-creation strategy with a specific timeline and exit target that has consistently performed across over 491 partners.

Here’s how our playbook works:

We acquire at 20-40% below market value (instant equity), improve operations to drive 5-10× profit growth (value creation), exit at 3-5× EBITDA (premium capture),

And achieve total returns of 100-150%+ over 24 months (compressed timeline).

This is how private equity firms operate, except instead of being a passive LP in someone else's fund, you own the asset outright and control the timeline.

Our team executes the entire strategy. So you're not operating the business.

You're not managing marketing campaigns. You're not handling fulfillment logistics.

We source opportunities, conduct forensic due diligence, manage operations, implement growth strategies, and position for exit. You deploy capital and receive regular progress updates.

We've managed over $41.5 million in revenue.

And we have a number of documented case studies all showing the same thing: we consistently generate multiple returns for our partners…

With a good number recouping their initial investment with us months into working with us…

Now we understand that you may be skeptical of our process and claims… That is why we offer a 14-day ‘buy & launch’ evaluation period with zero obligations…

So you can assess this opportunity without having to commit with a heavy retainer like with some broker or agency.

Many investors accept whatever timeline the market gives them. You don't have to.

With operating businesses, you control when to enter, how aggressively to improve, and when to exit.

The timeline is yours and is not dictated by market cycles or fund lockups.

The question is: would you rather wait a decade for uncertain returns, or execute a strategy with defined milestones?

Then schedule a 1:1 consultation w/ one of our consultants at TrendHijacking.com and we’ll show you what’s possible with you.

物业信息

是的,可搬迁至其它地方。

可否搬迁

是的,可以在家经营。

在家经营

会员专区

我要咨询

请使用英文发送留言

* 您的姓名

▼

* 手机号码

* 电子邮箱

留言详情

所有广告信息均由卖家或其代表提供。我们不对信息的准确性、完整性或真实性进行核实,也不提供任何保证或担保。任何因此而产生的纠纷、索赔或决定,均应由买卖双方自行承担和解决。了解更多 如何避免诈骗。